Now Reading: National Political Parties collected Rs 689.44cr during FY 2017-18 from unknown sources

-

01

National Political Parties collected Rs 689.44cr during FY 2017-18 from unknown sources

National Political Parties collected Rs 689.44cr during FY 2017-18 from unknown sources

Political Parties play a key role in democracies as they contest elections, form governments, formulate policies and are responsible for providing governance and improve the lives of the common man. Political parties need access to money in order to reach out to the electorate, explain their goals/policies and receive inputs from people. But where do they collect their funds from?

An analysis of their Income Tax returns and donations statements filed with the Election Commission of India (ECI) shows that the sources remain largely unknown. At present, political parties are not required to reveal the name of individuals or organizations giving less than Rs. 20,000 nor those who donated via Electoral Bonds. As a result, more than 50% of the funds cannot be traced and are from ‘unknown’ sources. While the National Political Parties were brought under the RTI Act by the CIC ruling in June 2013, they have still not complied with the decision. Full transparency is, unfortunately, not possible under the current laws, and it is only the RTI that can keep citizens informed.

Observations of ADR

- Between FY 2004-05 and 2017-18, the National Parties have collected Rs 8721.14 cr from unknown sources (links to reports given in ‘Reference’).

- During FY 2017-18, BJP declared Rs 553.38 cr as income from unknown sources which is 80% of the total income of National Parties from unknown sources (Rs 689.44 cr). This income of BJP forms more than 4 times the aggregate of income from unknown sources declared by the other 5 National Parties.

- Out of Rs 689.44 cr as income from unknown sources, share of income from Electoral Bonds was Rs 215 cr or 31%.

- Combined income of INC and NCP from sale of coupons between FY 2004-05 and 2017-18 stands at Rs 3573.53 cr

- According to the donations reports (containing details of donations above Rs 20,000), Rs 16.80 lakhs was given to the National Parties by cash. Mode of contribution of Rs 689.44 cr of unknown sources will remain unknown.

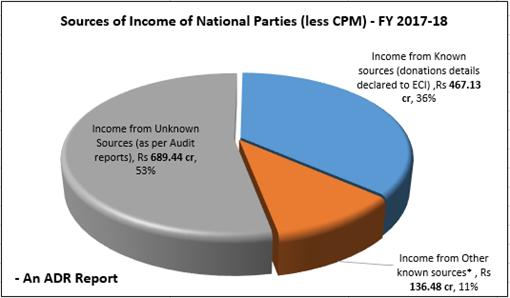

Income of Political Parties from Known, Other known and unknown sources

- For this report, known sources have been defined as donations above Rs 20,000, whose donor details are available through contributions report as submitted by national parties to the ECI.

- The unknown sources are income declared in the IT returns but without giving source of income for donations below Rs. 20,000. Such unknown sources include ‘Donations via Electoral Bonds’, ‘sale of coupons’, ‘relief fund’, ‘miscellaneous income’, ‘voluntary contributions’, ‘contribution from meetings/ morchas’ etc. The details of donors of such voluntary contributions are not available in the public domain.

- Other known sources of income include sale of moveable & immoveable assets, old newspapers, membership fees, delegate fee, bank interest, sale of publications and levy whose details would be available in the books of accounts maintained by political parties.

- For this analysis, 6 National Parties were considered, less CPM, as the ‘Schedules’ or ‘Annexures’ were unavailable for CPM for FY 2017-18. Schedules contain specific details of income from various sources, without which ADR was unable to analyse sources of funding of CPM.

- Total income of 6 National political partiesin FY 2017-18: Rs 1293.05 cr.

- Total income of political parties from known donors (details of donors as available from contribution report submitted by parties to Election Commission): Rs 467.13 cr, which is 36% of the total income of the parties.

- Total income of political parties from other known sources(e.g., sale of assets, membership fees, bank interest, sale of publications, party levy etc.): Rs 136.48 cr, or 11%of total income.

- Total income of political parties from unknown sources(income specified in the IT Returns whose sources are unknown): Rs 689.44 cr, which is 53% of the total income of the parties.

- Out of Rs 689.44 cr as income from unknown sources, share of income from Electoral Bonds: Rs 215 cr or 31%.

* Other known income include: sale of moveable & immoveable assets, old newspapers, membership fees, delegate fee, bank interest, sale of publications and levy

**Details of income from unknown sources is given in Annexure – 1; Party-wise sources of income is given in Annexure – 2

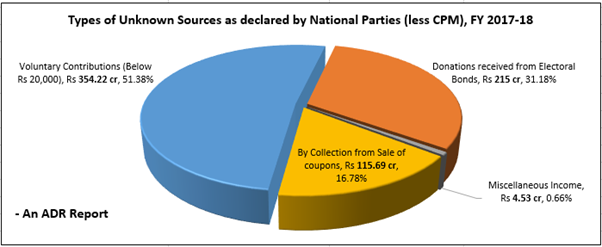

Income from unknown sources

- Out of total income of Rs 689.44 cr of 6 National Parties from unknown sources, 51.38% or Rs 354.22 cr came from Voluntary contributions (below Rs 20,000).

- Donations from Electoral Bonds formed 31.18% (Rs 215 cr) in income from unknown sources, while income from sale of coupons declared by INC and NCP formed 16.78% of income from unknown sources of the six National Parties.

Recommendations of ADR Report

- Mode of payment of all donations (above and below Rs 20,000), income from sale of coupons, membership fees, etc. should be declared by the parties in the ‘Schedules’ of their audit reports, submitted annually to the Income Tax department and the ECI.

- Recently, the ECI has recommended that tax exemption be awarded only to those political parties which contest and win seats in Lok Sabha/ Assembly elections. The Commission has also recommended that details of all donors who donate above Rs 2,000 be declared in public domain. ADR supports ECI for its strong stand to enforce reforms in funding of political parties and hopes that these reforms are proactively taken up by the Government for implementation.

- Scrutiny of financial documents submitted by the political parties should be conducted annually by a body approved by CAG and ECI so as to enhance transparency and accountability of political parties with respect to their funding.

- The National and regional political parties must provide all information under the Right to Information Act. This will only strengthen political parties, elections and democracy.