Now Reading: KYC in 2025: How Online Casinos Verify You Without Slowing You Down

-

01

KYC in 2025: How Online Casinos Verify You Without Slowing You Down

KYC in 2025: How Online Casinos Verify You Without Slowing You Down

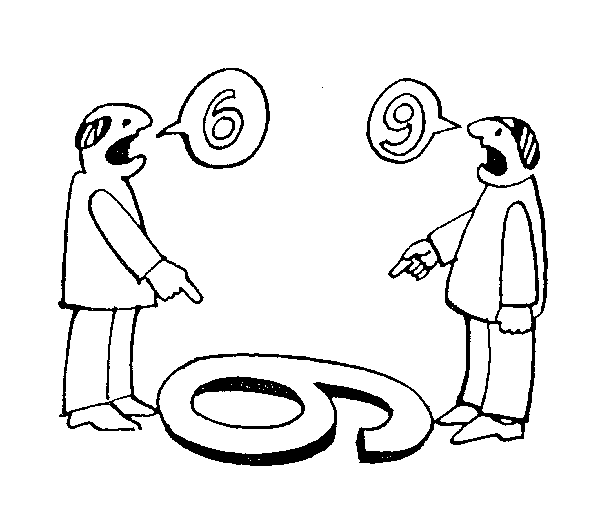

For years, “know-your-customer” verifications were the choke point between first click and first bet. In 2025 came a new generation of Online Casinos came that flipped that on its head, offering sub-20-second registrations while making regulators smile, who increasingly expect real-time, risk-based due diligence across the player lifecycle.

The result is a smoother funnel for operators (and far safer terrain for consumers) just as stiffer UK, EU, and U.S. regulations come into effect this year.

Regulation and Consumer Expectation Are Converging

The UK Gambling Commission’s 2025 package requires real-time age verification and tougher marketing approvals. Across the Atlantic, FinCEN’s proposed AML/CFT overhaul prescribes transparent, risk-based KYC programs for all types of casinos.

In between, consumers who have grown accustomed to one-tap fintech apps leave behind any onboarding process taking longer than the length of a brief video. Meeting both requirements necessitates technology that risk scores, identity verifies, and clears a deposit in seconds, not days.

Biometrics Over Deepfakes: The New Arms Race

Synthetic ID fraud has taken off with generative AI, leading operators to strengthen defenses. Modern KYC stacks document verification on top of biometric liveness checks, tracking micro-movements, depth, and thermal signatures that a deepfake cannot mimic.

Vendors now compare thousands of facial vectors to an international network of fraud intelligence in real time, flagging anomalies before account funding. Notably, these verification checks are performed behind the scenes as a user scans a passport or captures a selfie, taking less than five seconds from the process.

Open-Banking Data: Proof of Funds and Identity

Open-banking APIs are the unsung heroes of fast KYC. With the customer’s consent, the casino initiates a ping to their bank for name, age, address, and affordability indications in a single encrypted call.

The response serves as identity verification and source-of-funds verification simultaneously, overcoming the yesteryear trouble of uploading bills or payslips. Operators report onboarding costs dropped 30 percent, and verification time has been reduced from hours to minutes.

Pay N Play 2.0: Where the Deposit is the KYC

Trustly’s Pay N Play® NextGen follows the model a step further: the first $25 deposit authenticates the player via bank-verified credentials simultaneously, combining registration, KYC, and funding into a single step.

The newest incarnation, unveiled at ICE 2025, drops average login time from 48 seconds to under ten. Competition gateways now mirror the template with real-time IBAN verification and automatic proof-of-ownership, making the “upload later” approach obsolete.

Reusable Digital Wallets and the EUDI Framework

Europe’s new Digital Identity Wallet will allow citizens to store state-issued credentials (passport, driving license, age verification) on a mobile device.

Casinos as “relying parties” will receive cryptographic attestations without ever touching raw personal information, eschewing document uploads altogether and cutting onboarding to a fraction-of-a-second handshake. Its implementing regs were approved in late 2024, and pilot integrations begin this summer. Other jurisdictions, from Ontario to Singapore, are codifying similar models.

Dynamic, Risk-Based KYC: Authenticating What Counts

New systems do not use the same rules to everybody. Someone who’s a low-risk customer from a domestic bank might trigger passive monitoring, while someone who deposits using a high-risk crypto asset faces more intensive, full-document checks and ongoing behavioural monitoring. The latest risk bulletin by the UK regulator puts crypto on as “high-risk” and demands increased checks from April 2025. By deploying resources where peril is highest, operators keep most users at fintech speed.

Data Protection and User Trust

Speed is meaningless if privacy is sacrificed. Best-practice operators encrypt biometric templates, silo PII from game data and apply hard retention limits: often purging raw documents once a compliance snapshot is hashed and stored on a private ledger.

The approach complies with GDPR data-minimisation principles while giving auditors an immutable record in the event of suspicious activity.

Compliance Playbook for 2025

- Implement Multi-Factor Identity Orchestration: Unify document, biometric, and bank-data layers through one API gateway to route checks by jurisdiction and risk.

- Utilize Open Banking Everywhere Possible: It reduces verification time in half and provides integrated affordability metrics that regulators demand more of.

- Test Digital Identity Wallets Early: Early adopters will have the lowest abandonment rates when EU-wide adoption reaches the tipping point.

- Incorporate Ongoing Monitoring: Behavioural analytics and transaction screening need to operate after onboarding; KYC is not a static event.

- Document Everything: Automated audit logs against AML/CFT requirements guarantee smooth regulatory audits.

Conclusion

By 2025, the paradox of online gambling compliance is finally disappearing: robust KYC no longer holds back good consumers. Biometric liveness, open-banking rails, and re-useable digital credentials work together to deliver sub-ten-second account openings, with regulators being offered sharper tools in their battle against money laundering and fraud.

Early-adopting operators not only satisfy auditors but also win the loyalty of players accustomed to a frictionless start of each game.