Charles Adams, Clifford Chance Global Managing Partner, comments:

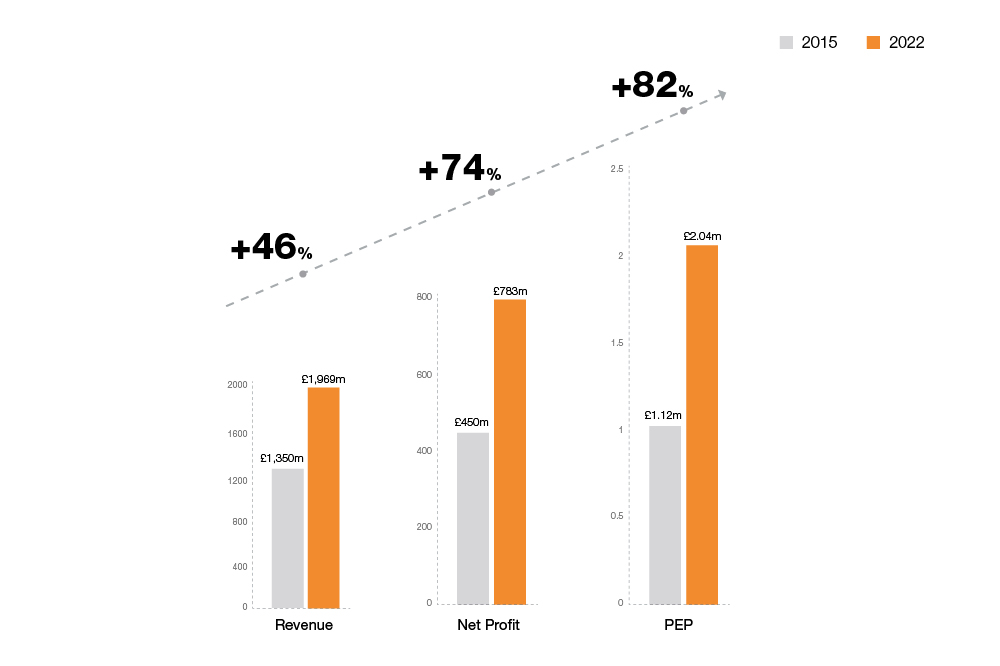

“Our team has delivered another outstanding year of results. We are seeing the positive outcome of our long-term strategic focus to diversify our client base, continually increase our market share and growth in priority geographies such as the Americas. These results are a testament to Matthew Layton’s leadership as the previous Global Managing Partner, as well as the energy, dedication, teamwork and phenomenal expertise of all our colleagues. It is because of this that, profit per equity partner increased by 10% year on year to in excess of £2m.

“Clients are at the heart of everything we do. To serve them better, we continue to prioritise our relationships with them and the delivery of our balanced combination of expertise and our increasingly global focus. Despite geopolitical uncertainty and signs of a slowdown in some markets, all our regions grew in income and net profit”.

Our Global Platform

Clifford Chance’s global platform gives the firm a position of strength and confidence looking ahead. New mandates with market-leading businesses including Cinven, Mercer, NMC Healthcare, as well as many more, show the excellent progress against our goals which we achieved by taking a long-term view and making strategic investments in our business while remaining agile and adaptable.

The firm’s diverse portfolio of clients and services delivered revenue growth in practice areas and we have now seen an almost doubling of revenue in financial investors over the last seven years. The firm’s highly regarded corporate advisory practices, as well as the global financial markets team experienced significant peaks in activity levels, contributing to overall growth.

Continued priorities and investment in our People strategy

Investment in our people has and will continue to be an important priority and we are committed to delivering the firm’s People, Talent and Inclusion strategy today and in the years to come.

Throughout the last 12 months, we have seen a transition to hybrid working across the firm. Our support for the wellbeing of our people has been a key priority throughout the global pandemic and as people adapt to new ways of working. Clifford Chance continues to work hard to ensure the experience of all our colleagues allows them to thrive in their roles and develop their expertise and long-term career goals.

The firm has made progress against its global inclusion goals, including meeting inclusion targets for gender and ethnicity, which were comfortably passed in the UK and US. This year saw the highest percentage of promoted female partners at 41% and the 3-year 5% LGBT partner goal was exceeded ahead of schedule.