Now Reading: Top Questions About Maternity Leave

-

01

Top Questions About Maternity Leave

Top Questions About Maternity Leave

The Canadian government recognizes the emotional importance of parenthood in the lives of its citizens and allows them to experience its joys to the fullest through state-backed schemes such as the Employment Insurance program; which also offers key maternity & parental benefits to expectant parents.

However, there is a general lack of clarity with respect to the topic of maternity leave in Canada and through this article, we hope to address the top questions regarding this topic, as well as, dispel any ambiguity surrounding it.

- How long can my maternity leave be valid?

Generally, you can apply for maternity leave for a maximum period of 17 weeks. You can take your maternity leave at any point from the beginning of your third trimester (13 weeks before the due date, to be precise), provided it doesn’t stretch beyond a time period of 17 weeks from the date of delivery. However, the duration of maternity leave differs from one province or territory to the next; therefore it is best to educate yourself about the rules in your province or territory before you apply for maternity leave.

In order to be eligible for maternity benefits, you must qualify for insurable employment; which means that you must have clocked a minimum of 600 hours of insurable employment within the last one year of employment.

- Can I rejoin my workplace before my rejoining date?

Yes, you can rejoin your place of employment before your rejoining date. However, at most workplaces employees need to send in an official request addressed to the Human Resource Manager four weeks before the date they intend to rejoin the firm.

It is, however, important to remember that once you begin your maternity leave, you cannot pause it or have your days readjusted to a later date and club them together with other holiday periods.

- What is the difference between maternity leave and parental leave? What is the duration of parental leave?

Only birth mothers can avail of the benefits of maternity leave. Parental leaves are meant for both parents and remain valid in the case of adoptive parents too. It reflects Canada’s commitment to ensure that the transition into parenthood is smooth for its citizens. Parental leaves can be opted for a period of 35 weeks by both parents in the year following their child’s birth or adoption.

- What is the Federal Employment Insurance and how to check your eligibility?

Federal Employment Insurance is a state-backed venture which provides new or expectant parents with financial support so that they do not have to compromise on the safety and well-being of their newborn or miss out on the experience of parenthood.

Most employers generally deduct Employment Insurance (EI) premiums from their employees’ salaries. Business owners or self-employed individuals have the option of paying Employment Insurance premiums if they wish to avail its benefits in the future.

It’s important to note that salaried employees must have clocked 600 insurable working hours over the last one year and self-employed individuals must have paid Employment Insurance for a period of one year or more before requesting its benefits.

- How much money can I expect to receive through EI?

Under EI’s maternity benefits, you are entitled to receive 55% of your regular weekly wages for a maximum period of 15 weeks.

After this period applicants can further avail of EI’s parental benefits, whereby either of the two parents can choose to take a leave of up to 35 weeks and continue to receive 55% of their regular weekly wage throughout the period.

Recently, the government of Canada decided to extend its Maternity Leave benefits to a period of 18 months; whereby after the end of the initial 15 weeks of maternity leave, either parent can choose to take up to 61 weeks of parental leave during which they will continue to get paid at the rate of 33% of their regular weekly salary. The payment rate remains unchanged for the initial 15 weeks of maternity leave.

It is imperative to remember that EI’s financial assistance qualifies as taxable income and is taxed as such by the federal and provincial tax authorities. If you are self employed it is important to know that you may still be eligible for maternity allowance. Self employed maternity pay will differ per country, but in Canada if you are eligible you can expect to receive around 55% of your earnings from self-employment. There is a limit to this amount and you will need to be signed up for the EI program for atleast 12 months, with proof of a certain amount of self employed earnings.

- Does my employer have to pay me my wages or any sort of financial compensation during my maternity leave?

No, your employer isn’t bound by law to pay you any sort of financial compensation during the leave period.

However, some employers choose to pay their employees on top of the EI benefits they receive. You can enquire about the same with your firm’s HR or founder.

- Am I at the risk of losing my employment if I’ve applied for maternity leave?

Your employer cannot fire you from your job because you are pregnant, as long as your condition doesn’t debilitate you from discharging your duties. Similarly, you cannot be demoted on the sole pretext of your pregnancy.

- When and how can I apply for EI maternity and parental benefits?

You can check your eligibility and directly apply for your EI maternity and parental benefits on the Government of Canada’s official website.

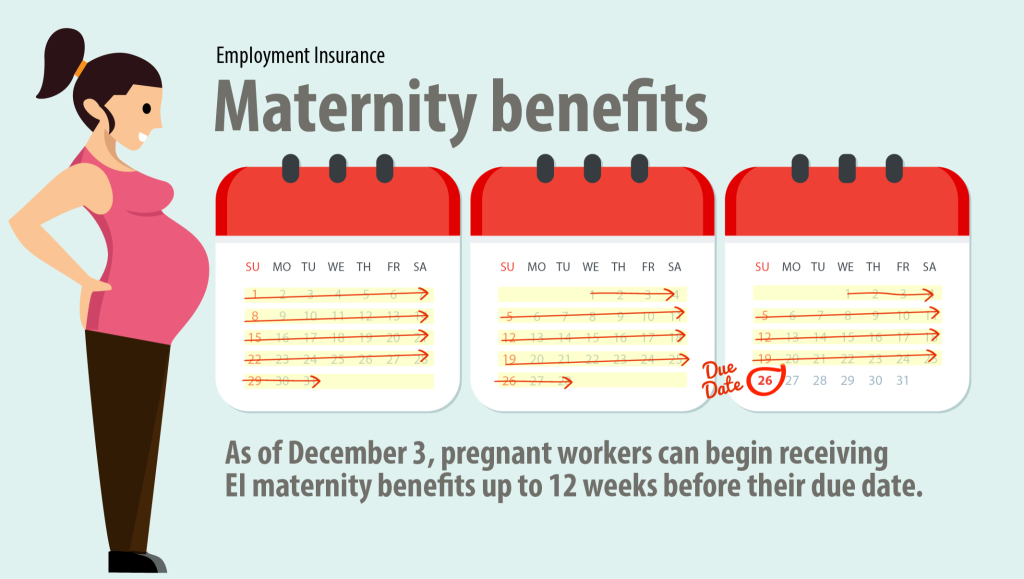

We would advise you to apply for your EI maternity and/or parental benefits as soon as you can begin to receive EI maternity benefits from the onset of your third trimester itself, or roughly 12 weeks before your due date.

If you have surpassed that stage and have recently stopped working at your workplace then we would advise you to apply right away so that you don’t miss the government’s four-week deadline from availing of EI benefits.

If you feel that you have been fired simply due to your pregnancy, then we suggest you get in touch with a team of qualified legal experts. Our reputed and trusted professionals here at De Bousquet in Hamilton will be glad to analyze your case in-depth and subsequently inform you about the legal resources at your disposal as well as about what you can consider being a fair severance payout.

Contact us at 416-616-5628 and we would be happy to answer any of your queries regarding parental and maternity leave in Canada.